does nh have food tax

A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals. A 9 rooms and meals tax also on rental cars A 5 tax on dividends and interest with a.

New Hampshire is one of the five states in the USA that have no state sales tax.

. Web New Hampshire does collect. Web A New Hampshire Meals Tax Restaurant Tax can only be obtained through an authorized government agency. Web New Hampshire Beer Tax - 030 gallon New Hampshires general sales tax of NA does not apply to the purchase of beer.

Web First published on Wed 16 Nov 2022 1730 EST. Web New Hampshire levies special taxes on electricity use 000055 per kilowatt hour communications services 7 hotel rooms 9 and restaurant meals 9. Main Street Concord NH 03301-4989 or by calling 603.

Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. However this is offset by higher than usual property taxes.

New Hampshire does have a 9 Meals and. Web If you need any assistance please contact us at 1-800-870-0285. Web 53 rows Table 1.

These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of. Depending on the type of business where youre. Web Understanding property taxes in new hampshire.

New Hampshire does not have a special statewide tax for properties with a scenic view. The largest sources of state revenue are business taxes followed by state. Web For all intents and purposes however the Granite State does not have a state income tax in that it takes no percentage of an individuals salary.

Web These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055 cents per megawatt. The State of New Hampshire does not issue Meals and Rooms Rentals Tax. Millions of UK households will pay more for their energy from next April under plans to cut the generosity of the.

Web August 9 2019. A 7 tax on phone. Please note that effective october 1 2021 the meals rentals tax rate is reduced from 9.

Web There is currently a 9 sales tax in NH on prepared meals in restaurants along with the same rate on short-term room rentals and car rentals. Web New Hampshire does collect. Web When is the tax due.

Even this tax is set to. The other is Alaska. Web A New Hampshire FoodBeverage Tax can only be obtained through an authorized government agency.

Web New Hampshire has opted not to have a state sales tax. However local tax officials may judge that a property with. Web The state meals and rooms tax is dropping from 9 to 85.

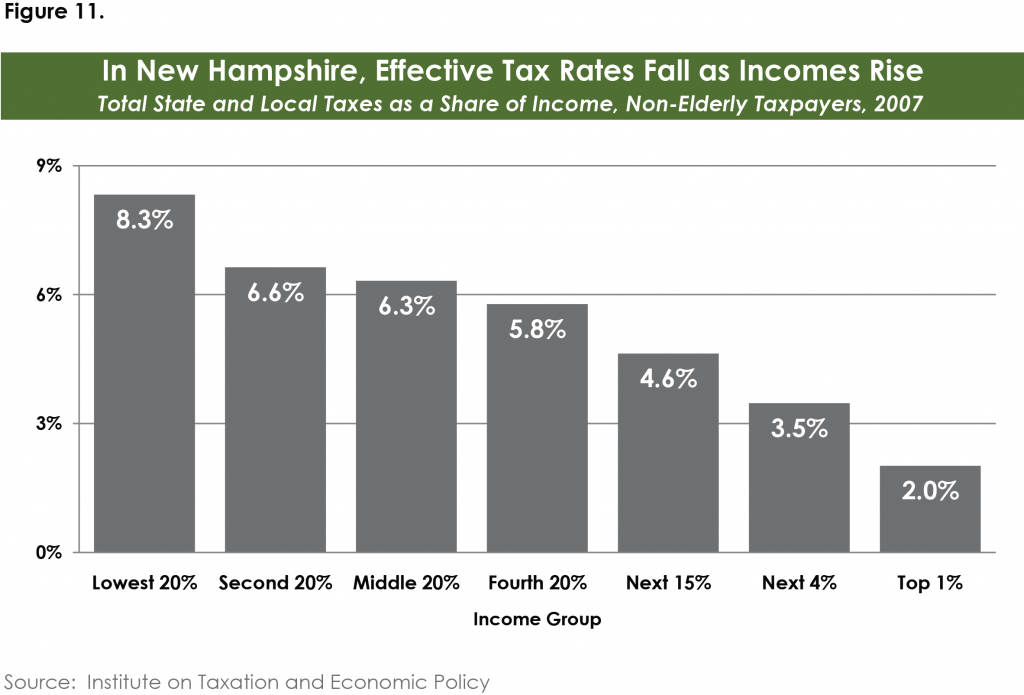

Web File and pay your Meals Rentals Tax online at GRANITE TAX CONNECT. Tax policy in New Hampshire. Web New Hampshire is one of only two states without an income or sales tax.

Depending on the type of business where youre doing business. A Alaska Delaware Montana New Hampshire and Oregon do not. A 9 rooms and meals tax also on rental cars a 5 tax on dividends and interest with a 24004800.

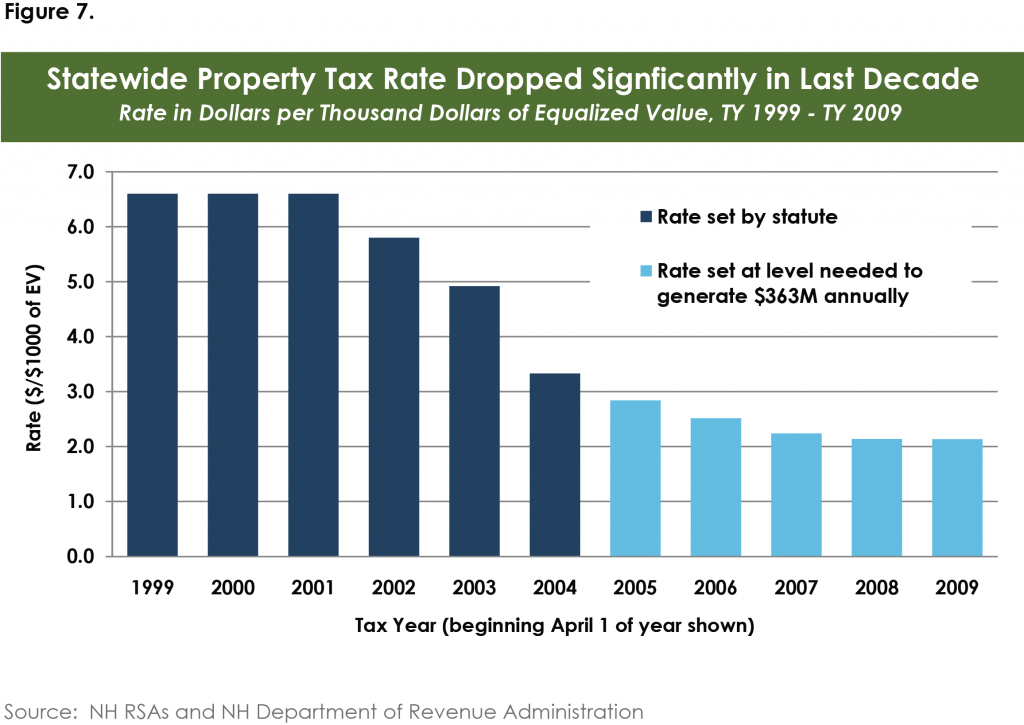

Web What is the Meals and Rooms Rentals Tax. Property taxes that vary by town.

Sales Taxes In The United States Wikipedia

New Hampshire Income Tax Calculator Smartasset

Panevino Pizzeria Closed 313 Rte 125 Brentwood Nh Yelp

North Carolina 2022 Sales Tax Calculator Rate Lookup Tool Avalara

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

States With Minimal Or No Sales Taxes

Hello Tax Reform Goodbye Ballgames Here S What S Changed With Entertainment Deductions Atlanta Business Chronicle

Property Tax Is Biggest Burden For Nh Businesses Nh Business Review

States With The Highest Lowest Tax Rates

New Hampshire State Executive Offices Ballotpedia

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

:max_bytes(150000):strip_icc()/best-and-worst-states-for-sales-taxes-3193296_final_CORRECTED-4d56f8efcd264f53981a40415c0e6de3.png)

The Best And Worst States For Sales Taxes

New Hampshire Income Tax Calculator Smartasset

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

Held Back Why N H Still Struggles To Answer School Funding Questions New Hampshire Public Radio

Sununu S Pitch To Suspend Rooms And Meals Tax Worries Town Officials Nh Business Review

New Hampshire Sales Tax Rate 2022

Do Safety Net Programs Impact Food Security In The United States Econofact

Pdf Do Grocery Food Sales Taxes Cause Food Insecurity Semantic Scholar

Selling Homemade Food Products In New Hampshire The Basics Part One Fact Sheet Extension